Direct Method: Cash Received from Customers

Accounts receivable are amounts owed to a business by customers for credit sales invoiced to them on account. When a customer pays an invoice, an account receivable collection journal entry is required to clear the amount on their account. A cash receipts journal is a special journal used to record cash received by a business from any source.

Create a Free Account and Ask Any Financial Question

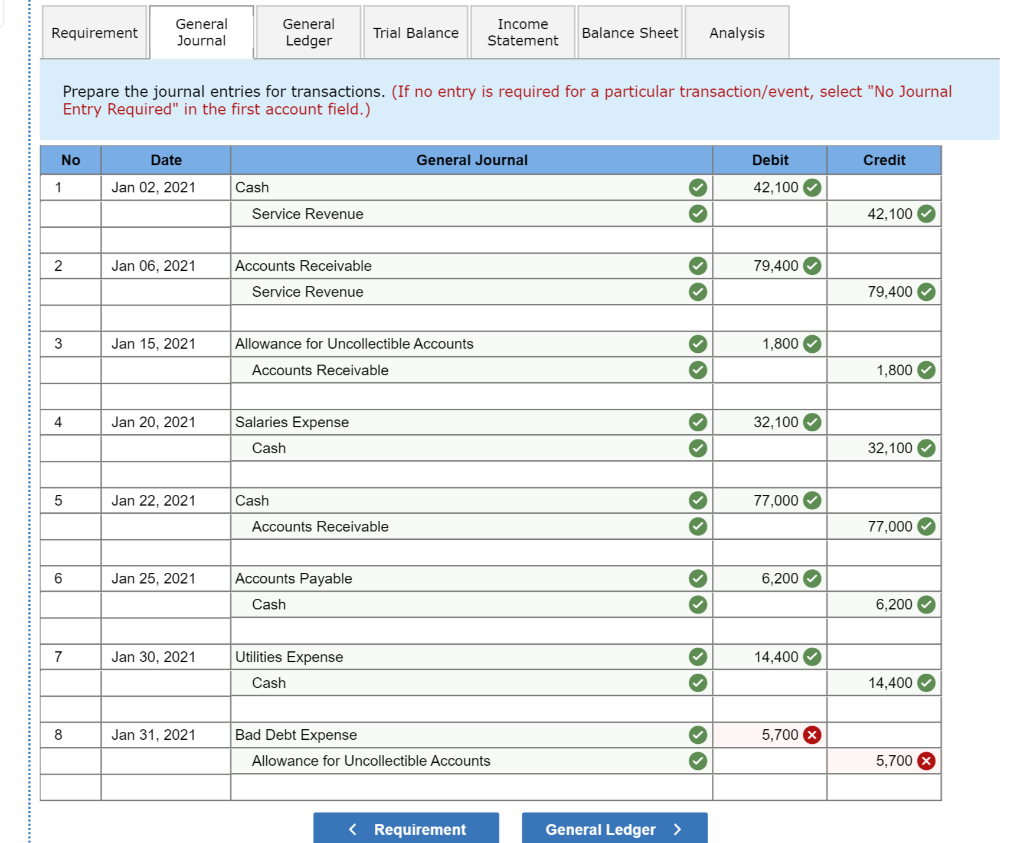

An example of a journal entry for received cash on accounts receivable would be similar to the following. When recording cash collections from customers it is quite common for the cash receipt journal to include a discounts allowed column. By using a discounts allowed column, the business can use the receipts journal to record the invoiced amount, the discount allowed, and the cash receipt.

- A cash receipt, on the other hand, is the record that says payment has been received for goods or services and the receipt is the proof of purchase for the buyer.

- Depending on a company’s requirements, different formats are used for a cash receipts journal.

- Alternatively, providing the cash advance relates to revenue, a deferred or unearned revenue account could have been used.

- If you sell goods that you have produced through your manufacturing division, then this would affect inventory.

- The Facebook and LinkedIn groups are also good areas to find people interested in accounting like yourself, don’t hesitate to join as everyone of all levels are welcome to become part of the community.

To Ensure One Vote Per Person, Please Include the Following Info

You can tweak the above steps to better fit the workflow of your company. The money is recorded as having moved from the special trust account to your business’ operating account. If you prefer to invoice customers for deposits or retainers instead of receiving them directly, skip to Option 2.

Information Listed in the Cash Receipts Journal

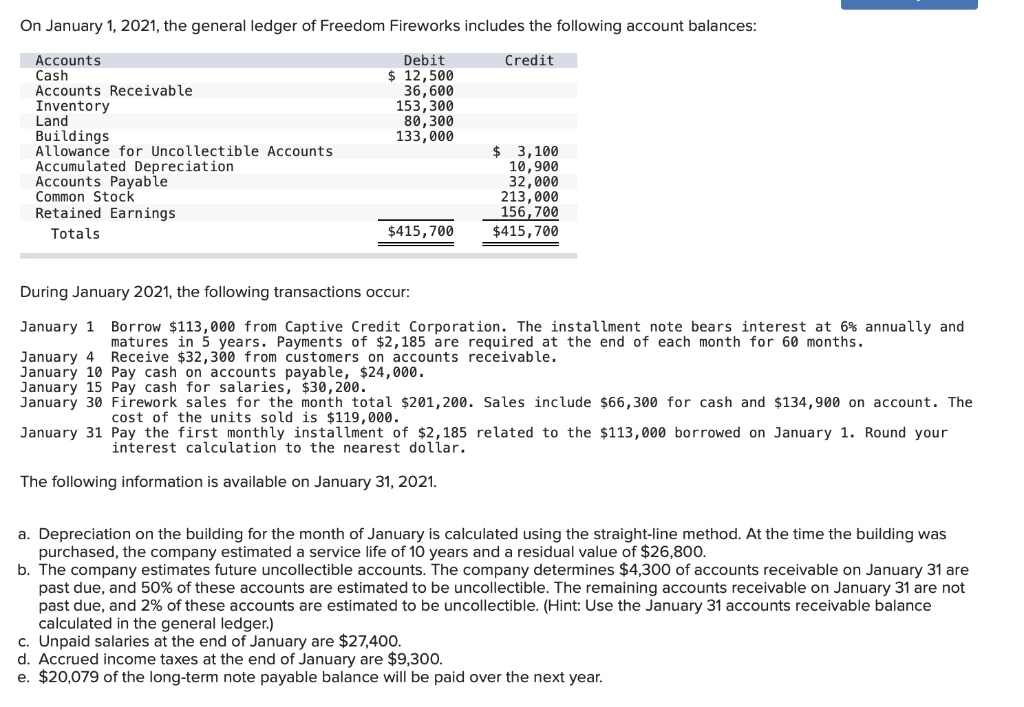

Without an invoice, company can still record revenue by using the accrued method. However, if the company provides service and receives cash at the same time, the company needs to record cash and sales revenue. It will increase the cash balance on the balance sheet and revenue on the income statement. If you lose one or more cash sales receipts, it may be difficult to have an accurate balance sheet because the cash account will be incorrect. An inaccurate balance sheet can lead to underestimation of business expenses and inflation of profit and revenue.

It will include topics like how to record cash receipts and what a cash receipt should include. Sales receipts typically include things like the customer’s name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable). The service is provided to the customer and payment from the customer is immediate using cash. There is no credit given to the customer for the provision of the service. Keeping track of revenues and expenses is a vital basic function for any business.

Create the cash received entry

In these cases, you will need to make a separate cash received journal entry to record this information. You must also track how these payments impact customer invoices and store credit. Now might be a good time to suggest to Nick that he create some kind of written agreement for his customers to clarify expectations. Assuming your business sells inventory to someone for the sales price of $1,000 then you would need to record this entry. Any time cash is received, it would be a debit to cash, as this is the normal balance of the account.

The debit columns in a cash receipts journal will always include a cash column and, most likely, a sales discount column. Other debit columns may be used if the firm routinely engages in a particular transaction. Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash what is the turbotax audit defense phone number receipts journal. The sale is invoiced to the customer, and the liability on the cash advances account is extinguished against the amount due from the customer on the accounts receivable account. In this case one asset (cash) increases representing money received from the customer, this increase is balanced by the increase in liabilities (cash advances account).

The seller must prepare the invoice as soon as the service provided is completed and submit it to the buyer within the agreed timeframe. The invoice should include all the relevant details such as the date of service, description of work, the amount charged, and any applicable taxes. Now, let’s say Nick went to Abe’s Bowling Emporium on the 16th and cleaned up after a birthday party.

The credit to the cash advances account represents a liability as the product still needs to be manufactured and delivered to the customer. As the goods or services have not been delivered, the revenue from the sale has not been earned, and the cash receipt must be recorded as a liability in the balance sheet. If delivery is expected within the next year, then the liability will be shown as a current liability, if not, then it should be shown as a long-term liability in the balance sheet. You can set up a deposit or retainer process for your company in QuickBooks Online. The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn’t belong to you until it’s used to pay for services. When you invoice the customer and receive payment against it, you’ll turn that liability into income.

Revenue is usually recorded when the service is provided, rather than when the payment is received. This is because businesses typically provide services on credit, and they want to record the revenue as soon as the service is provided. This ensures that they are able to track their revenue accurately and it is matching with the cost spent. The information recorded in the cash receipt journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger.

Recording cash deposits accurately helps a business track its income and expenses. It also reduces the time it takes for a business to determine how much income was collected from customers. If you sell goods that you have produced through your manufacturing division, then this would affect inventory. In this case, a business may record the collection of cash as an increase to cash or to another asset account. If a business sells services and those payments were collected in cash, then those payments would be put toward accounts receivable.