Understanding Forex Trading A Comprehensive Guide 1860297563

What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, is the process of buying and selling currencies in a global marketplace. This decentralized market is the largest in the world, enabling participants to exchange currencies at current or determined prices. Forex trading is particularly appealing for its high liquidity and the ability to engage in transactions 24 hours a day, five days a week. Those interested in learning more about Forex can find resources at what is forex trading https://acev.io/.

How Does Forex Trading Work?

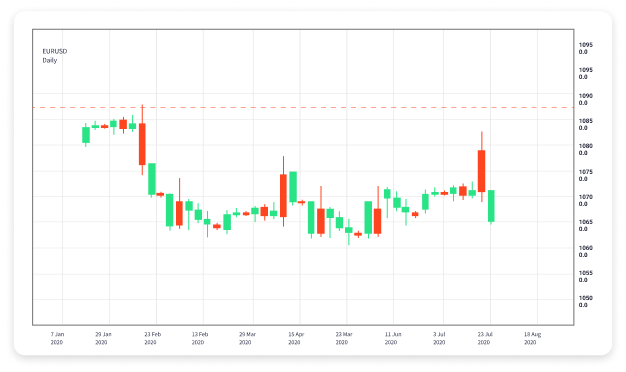

In Forex trading, currencies are traded in pairs. This means that when you buy one currency, you are simultaneously selling another. For example, if you trade the EUR/USD pair, you are trading the Euro against the US Dollar. If you expect the Euro to strengthen against the Dollar, you would buy the EUR/USD pair. Conversely, if you predict that the Euro will weaken, you would sell the pair.

Forex trading involves several key players, including:

- Central Banks: Institutions that manage a country’s currency, money supply, and interest rates.

- Commercial Banks: Major players in the forex market that facilitate transactions for their clients.

- Retail Traders: Individual traders who buy and sell currencies for personal accounts.

- Corporations: Companies that engage in forex trading for international business transactions.

Types of Forex Trading

There are several trading styles in the forex market, each suited to different traders based on their time commitments and risk tolerance. The main types include:

- Day Trading: This involves buying and selling currencies within a single trading day, with no positions held overnight.

- Swing Trading: Traders hold positions for several days or weeks, aiming to profit from expected market shifts.

- Scalping: A rapid trading style where traders make multiple trades throughout the day to capture small price movements.

- Position Trading: Long-term trading where positions are held for months or even years, based on broader economic trends.

Factors Influencing Forex Markets

The forex market is influenced by a variety of factors, including:

- Economic Indicators: Metrics such as GDP growth, employment rates, and inflation rates can impact currency value.

- Political Stability: Countries with less risk for political turmoil generally have stronger currencies.

- Interest Rates: Higher interest rates offer lenders a higher return relative to other countries, attracting foreign capital and causing the currency to appreciate.

- Market Sentiment: Traders’ perceptions and emotions can drive price movements in the forex market.

Getting Started with Forex Trading

If you’re interested in entering the world of forex trading, here are some essential steps to get started:

- Educate Yourself: Familiarize yourself with the forex market, trading strategies, and technical analysis.

- Choose a Reliable Broker: Research forex brokers and select one that aligns with your trading needs.

- Create a Trading Account: Open a trading account with your chosen broker, which may offer a demo account to practice without financial risk.

- Develop a Trading Plan: Identify your trading goals, risk tolerance, and strategies to guide your trading decisions.

- Start Trading: With a solid foundation, begin executing trades while continuing to learn from each experience.

Common Mistakes to Avoid

New traders often make several common mistakes that can hinder their success in forex trading. These include:

- Overleveraging: Using too much borrowed money can amplify both gains and losses, leading to significant financial consequences.

- Neglecting Risk Management: Always set stop-loss and take-profit levels to manage potential losses.

- Emotional Trading: Making impulsive decisions based on fear or greed can lead to costly mistakes.

- Lack of Strategy: Trading without a clear plan can increase the risk of losses and missed opportunities.

Conclusion

Forex trading offers significant opportunities for those willing to learn and adapt to the dynamic nature of the market. Understanding the fundamentals, developing a solid trading plan, and maintaining discipline are key factors for success. Whether you are a seasoned investor or just starting, remember that knowledge and experience play critical roles in achieving forex trading success. As you navigate this complex market, stay informed and continuously refine your strategies to enhance your trading performance.